CreditWorks Group is delighted to announce a new long-term partnership with Equifax New Zealand for access to Consumer Credit Reporting, launching on 1 June 2023.

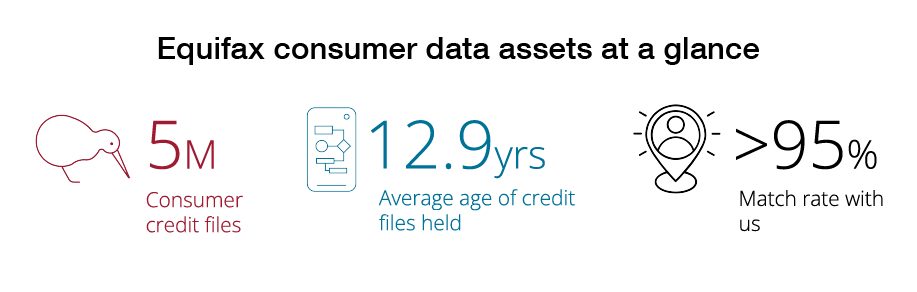

With 5 million credit files at an average credit file age of almost 13 years, delivering a 95% enquiry match rate, Equifax is one of NZ’s longest standing consumer credit bureau, offering consumer credit data with superior accuracy and quality. The Equifax consumer data and score will allow you to better understand the people behind the organisation’s CreditWorks helps you decide who to do business with.

More Robust. More Compliant.

For more than 20 years, CreditWorks has been committed to helping Kiwis manage risk through highly innovative and robust credit data solutions. With ISO27001 certification, CreditWorks is also uncompromising on data security and its commitment to compliance.

“We are pleased to be working with Equifax New Zealand for continued access to consumer credit reporting. Our Equifax relationship will not only bring our members access to more consumer data than ever before, but an enhanced level of data quality and compliance. It’s exciting for the CreditWorks team to be in partnership with a market-leading business whose values align so closely to our own.”

– Ronnie Tan – CreditWorks CEO / Founder

Introducing One Score: Equifax’s most predictive credit score ever

CreditWorks members will now have direct access to OneScore – Equifax New Zealand’s latest and most predictive consumer credit score. One Score is designed to predict the risk of an individual becoming 90+ Days Past Due with account repayments.

The development of One Score, Equifax’s most predictive consumer score to date, has included statistical and aggregated data elements to enable a meaningful and highly predictive score to be returned to credit providers even when there is little to no credit information otherwise available for an individual. This will ultimately make it easier for CreditWorks members to extend credit with greater confidence, and support positive decisions around financial inclusion.

Key Benefits of One Score |

|

Key Differences of One Score |

|

| Increased risk predictiveness: Reduced risk of Bad Debt

Enhanced revenue opportunities: Ability to leverage data and approve more credit applications Enhanced transparency: greater insight from Key Contributing Factors [KCFs] |

Introduction of Key Contributing Factors [KCFs]: Clear and simple explanation of the main factors that contributed to the score returned

More informed decision-making: allows credit providers to lend with enhanced confidence. |

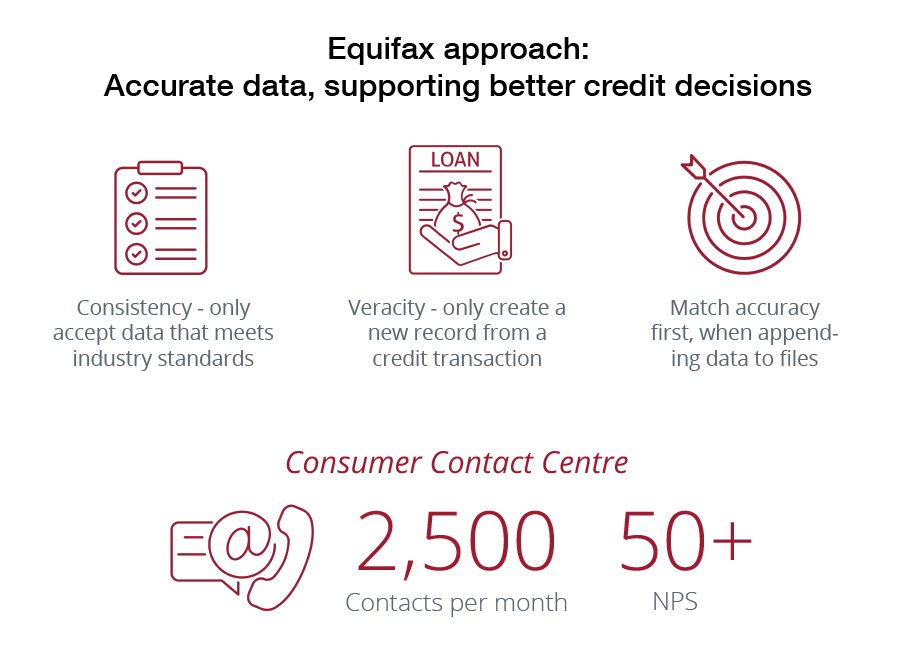

“We are excited to introduce Equifax One Score to CreditWorks customers, our most predictive consumer score yet, supporting faster and more accurate decisioning. Credit providers are able to better understand the risk of who they are doing business with and a more predictive score allows greater confidence and the ability to say ‘yes’ more often.

Equifax has a focus on consistent, transparent credit data across all industries, providing a strong foundation for stable and accurate scores. We know the importance of the credentials of the people behind the organisations you choose to do business with. The dynamic nature of Equifax One Score, helps give credit providers greater decision clarity.”

– Angus Luffman – Managing Director, Equifax New Zealand

Simple CRISworks Integration

Access to Equifax One-Score consumer data will be easy for our CRISworks members, who will be able to check the details of the Directors (with their consent), in conjunction with our Company Credit Report. CRISworks members will also have access to Equifax’s Consumer Credit reports for information on any Consumer, Sole Trade or Director.

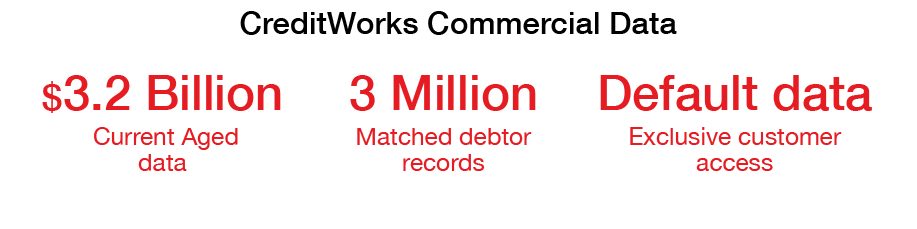

CreditWorks Commercial Data. More Compliant.

CreditWorks continues to maintain New Zealand’s largest number of commercial Trade Data suppliers in New Zealand. We currently hold $3.2 billion of current Aged data at peak times, with over 3 million matched debtor records. Our clients have access to increased default data provided from our key partners, and in addition default data from our clients that is restricted to CreditWorks users. Companies Office data, Public Notices and Judgements continue to be sourced and updated regularly on CRISworks and we constantly seek further enhancements to add to a deeper credit profile.

No change to current pricing

CreditWorks would like to assure you that as a result of this new partnership there will be no changes to your current pricing plan.

Continue to leverage your opportunities through data

Don’t hesitate to contact the CreditWorks team on 09 520 0626 or [email protected] if you would like to further discuss our new partnership with Equifax New Zealand.

Likewise, please get in touch if you would like to better understand all of the credit / data reporting solutions we offer – as these are all rich sources of opportunity for enhanced decision-making in your business every day.